sales tax in san antonio texas 2019

The average cumulative sales tax rate in San Antonio Texas is 823 with a range that spans from 675 to 825. The San Antonio sales tax rate is.

/https://static.texastribune.org/media/files/1be413a26fc39ce55f25ec32fa826c92/Glenn_Hegar_Biennial_Revenue_Estimate_1_TT.jpg)

A Texas Sales Tax Rule Hinges On A Question What S Local The Texas Tribune

In 2017 70 of high school students in Texas smoked cigars cigarillos or little cigars on.

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/DVILLENOKARFQ2WHDBDKLZLIT4.jpg)

. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. 625 san antonio tax 125. City sales and use tax codes and rates.

You will pay sales tax on an item bought online if the retailer has a store somewhere in the state of Texas. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. San Antonio collects the maximum legal local sales tax The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

Texas state rate 625. Texas Comptroller of Public Accounts. 2019 Kerrisdale Dr San Antonio TX 78260 782788 MLS 1639898 David Weekley Homes would like to welcome you to your luxurious new home.

The 825 sales tax rate in. Rules Texas Administrative Code. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent.

Please consult your local tax authority for specific details. The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in San Antonio. Local taxing jurisdictions cities counties special.

The sales tax for San Antonio is 625. This includes the rates on the state county city and special levels. In Texas the combined area city sales tax is collected in addition to state tax and any other local taxes transit county.

The December 2020 total local sales tax rate was also 8250. Sales tax in san antonio texas 2019 Tuesday September 6 2022 Edit. Other 2019 sales tax fact for San Antonio There is 74.

Published on August 2 2019 by Youngers Creek. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. 5 beds 45 baths 3541 sq.

What is the sales tax rate in San Antonio Texas. San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250. San antonio sales tax is at 815 percent still I 2019 San.

Supermarket News ranks H-E-B 13th on the list of Top 75 North American Food Retailers by.

Tax Rates And Local Exemptions Across Texas San Antonio Report

Pennsylvania 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Tax Rates Bexar County Tx Official Website

How To File A No Tax Information Report Youtube

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/DVILLENOKARFQ2WHDBDKLZLIT4.jpg)

Texas Gearing Up To Tax More Online Purchases But Slowly

Texas Gov Greg Abbott Other Top Officials Propose Raising The Sales Tax To Provide Property Tax Relief Houston Public Media

New York Taxes Layers Of Liability Cbcny

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Texas Used Car Sales Tax And Fees

Why Are Texas Property Taxes So High Home Tax Solutions

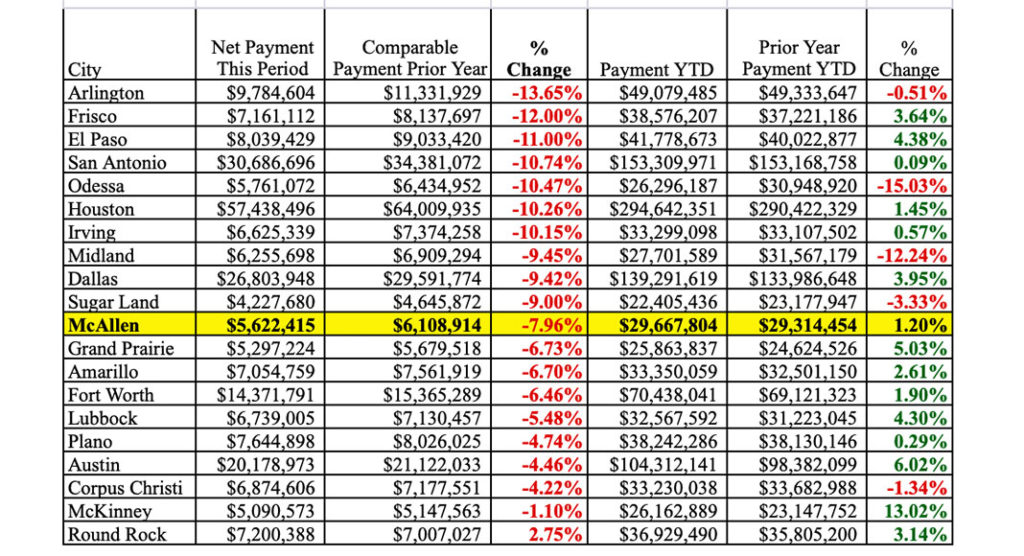

May 2020 Sales Tax Info Texas Border Business

Tax Information New Braunfels Tx Official Website

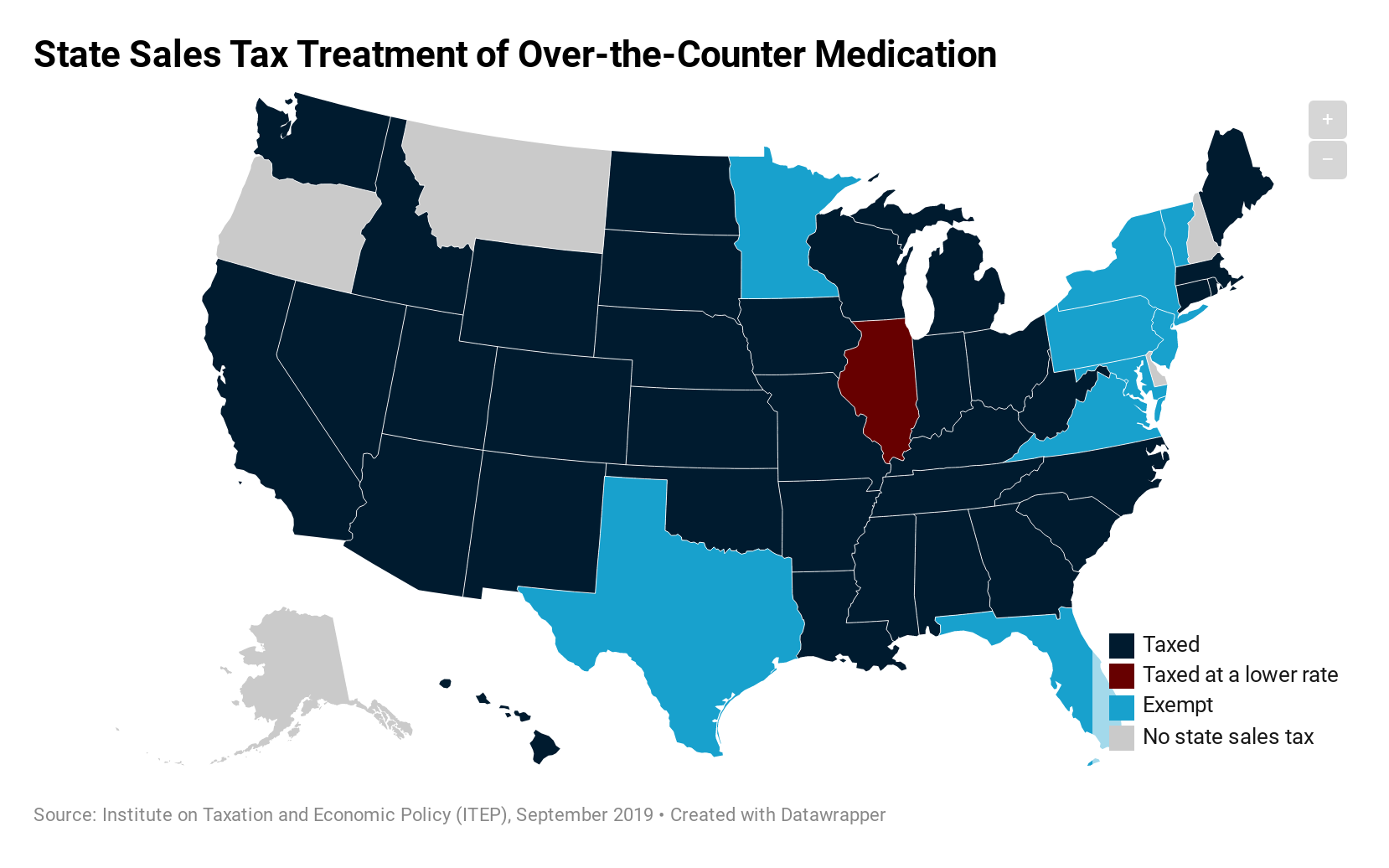

How Do State Tax Sales Of Over The Counter Medication Itep

What The Bleep Is Going On With Texas Property Taxes Texas Monthly